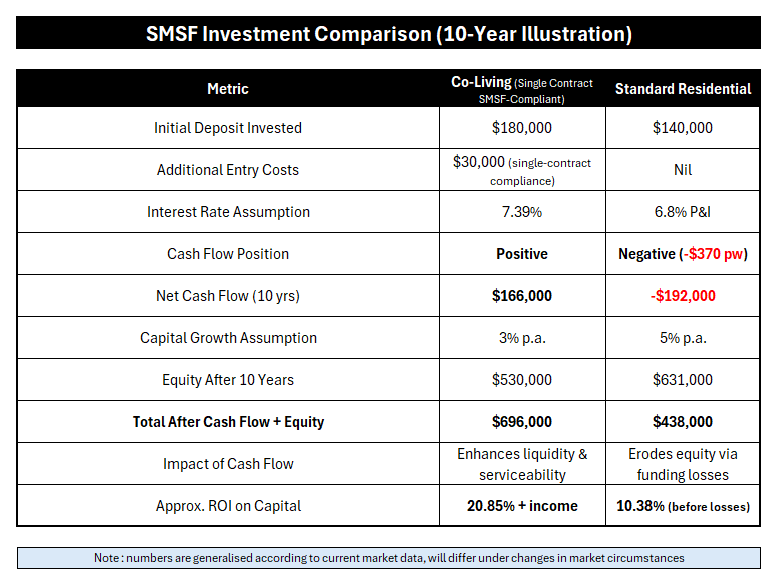

Comparison: Co-Living High-Yield Investment Property Versus Traditional Residential Housing

Having analysed the numbers, I remain confident that higher cash-flow assets are critical within an SMSF, particularly over a medium to long-term investment horizon. The summary below provides clarity and supports informed decision-making.

It makes investment sense that there is always a cost of doing business. What matters is the return on investment after all costs, measured over the life of the asset—not the emotional discomfort of visible upfront fees.

In an SMSF, where property expenses are deductible at only 15%, relying primarily on capital growth while funding ongoing losses can materially erode net outcomes. The comparison below highlights this risk.

📌 Why High‑Yield SMSF Investment Property Should Be Core to Your Super Strategy

If you’re serious about building lasting wealth in your SMSF, then income‑producing property — not just capital growth — should be front of mind. Here’s why high rental yield properties deserve a central role in your investment strategy, particularly within super:

💡 1. Your SMSF Needs Cash Flow — Not Just Paper Gains

Inside an SMSF, rental income isn’t just “nice to have” — it’s strategic fuel for growth:

-

Consistent rental yields support positive cash flow, reducing cash drag from loan servicing, maintenance and compliance costs.

-

With positive cash flow, you avoid diverting contributions simply to fund losses — meaning more of your money stays invested and compounding.

-

Healthy yield increases your borrowing capacity under a Limited Recourse Borrowing Arrangement (LRBA), allowing your SMSF to acquire bigger and better assets sooner.

In other words, rental yield drives sustainability — it keeps your fund competitive, serviceable, and positioned for further growth.

📈 2. Income Matters at Retirement

As you approach pension phase, rental income from high‑yield assets becomes retirement cash flow — and in many cases:

✔ Rental income inside an SMSF can be taxed at just 15% during accumulation — and potentially 0% once in pension phase.

✔ Capital gains are also tax‑advantaged — discounted to 10% if held >12 months, and tax‑free in pension phase.

This means your SMSF is not only building wealth — it’s generating income that can support your lifestyle without eroding principal.

📊 3. Yield Enhances Total Returns When Growth Isn’t Guaranteed

It’s a common mistake to assume capital growth alone will pay off your retirement — but growth is not guaranteed, and in some markets growth can be very slow or less than you hoped for :

📉 Many high‑yield locations currently deliver strong rental returns and capital growth potential.

For SMSF’s, this dynamic of higher yield strategy is important because:

-

Rental yield contributes every year to your fund’s cumulative return.

-

Capital growth only pays out when you sell — which may be years away or illiquid when you need income.

A property with strong yield compounds returns more consistently inside a tax‑efficient SMSF structure than one relying on price appreciation alone.

📌 4. High Yield Improves Loan Serviceability and Portfolio Expansion

For SMSF trustees who borrow to invest :

🔹 Strong rental income supports loan repayments and improves serviceability.

🔹 This means less pressure on cash reserves, fewer capital calls from members, and greater ability to scale your SMSF property portfolio over time.

🔹 When rent coverage is strong, your SMSF is positioned to pursue second or third acquisitions faster — true power of accelerating wealth creation.

🧠 5. Balance Capital Growth with Yield for a Complete Strategy

This isn’t about dismissing capital growth — both yield and growth matter, but the weighting should depend on your retirement goals :

✔ Yield creates cashflow and resilience.

✔ Capital growth adds equity.

✔ Together they deliver total return — the compound driver of long‑term wealth.

In SMSF’s, because of the unique tax environment, a strong yield can enhances overall long‑term return more reliably than an asset that only appreciates in value but produces weak income.

🏁 Bottom Line for SMSF Property Investors

If your goal is to grow super into a reliable income engine for retirement, then yield should not be an afterthought:

👉 High rental yield properties help your SMSF fund service debt, generate real income, and compound growth more sustainably than a pure capital growth focus.

Capital growth adds value over time, but yield keeps your fund liquid, serviceable and leverage‑ready. That’s the difference between equity sitting on paper — and a fund that’s actively building wealth every year.

Key Observations of above table :

- While the standard residential option assumes higher capital growth, this is partially offset by -$192,000 in funded losses over 10 years.

- The Co-Living strategy:

- Recovers upfront compliance costs early,

- Produces ongoing positive cash flow, and

- Improves loan serviceability and SMSF liquidity.

- Example : If SMSF contributions are approximately $20,000 p.a., and a negatively geared property requires -$19,000 p.a. to fund the shortfall, lenders may question loan sustainability. Most contributions are otherwise diverted to servicing losses rather than compounding growth.

Strategic Consideration

Positive cash flow from the Co-Living asset also enables:

- Faster accumulation of a second deposit, and

- More efficient growth of the SMSF’s asset base compared with relying solely on capital appreciation while funding losses.

Retirement Outcome Perspective

At retirement, it’s important to remember: equity alone does not generate income—your assets do.

Co-Living (10-year horizon @ 1% CPI rent growth):

-

Approx. $98,000 p.a. income

-

Potential total position (cash flow + equity) over 10 years: $696,000

Standard Residential (10-year horizon @ 1.5% CPI rent growth):

-

Approx. $33,000 p.a. income

-

Potential total position (cash flow + equity) over 10 years: $438,000

The practical question this raises:

“Would you rather hold a high-income property into retirement, or be forced to sell a lower-yielding asset and reinvest the equity just to generate the income you need?”